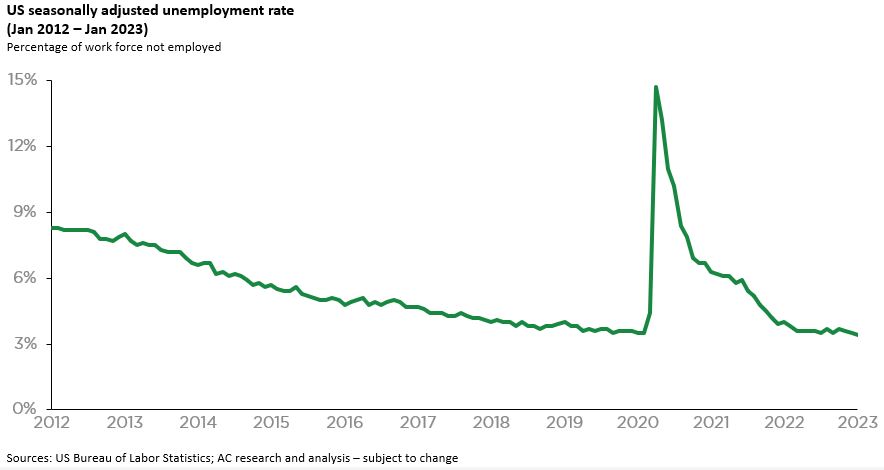

US unemployment is low. Really low. The Bureau of Labor Statistics estimated the US seasonally adjusted unemployment rate in January 2023 was 3.4%. That is the lowest monthly figure since May 1969.

The unemployment figure matters for several reasons including its impact on wages and earnings. When labor markets get tight, employers tend offer better compensation to attract the workers they need. US hourly earnings increased at 4.3% compounded annually over the last 5 years as unemployment rates remained comfortably under 5%. In the prior decade from 2008–2018, unemployment rates ranged from 10% to 5%, and hourly earnings rose at only 2.4% compounded annually.

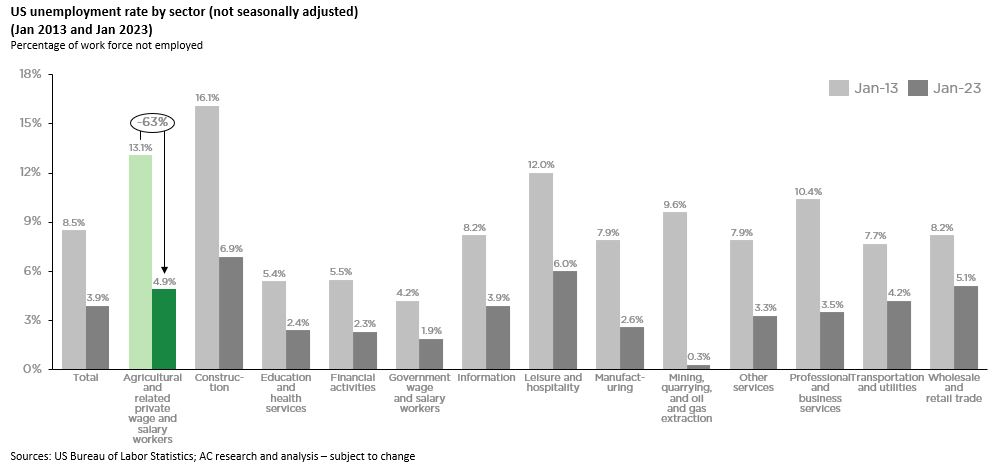

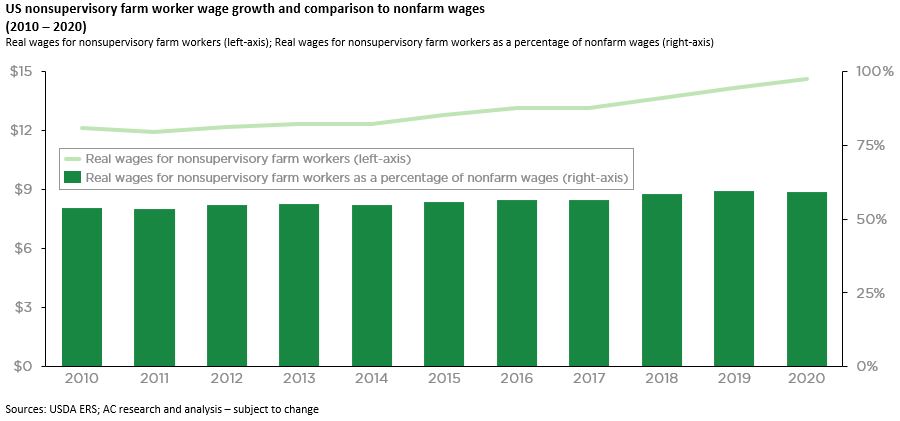

Ag investors and operators are highly aware of and sensitive to the impact of tight labor markets on financial performance. Over the past decade, few other sectors have seen the same rate of decline in unemployment as the ag industry. Unemployment among ag workers declined by 63% between January 2013 and January 2023, from 13.1% to 4.9% (not seasonally adjusted). Over the same timeframe, wages in the ag sector rose at a faster rate than wages in the rest of the economy.

Higher operating costs are not the only problem. In some cases, growers simply do not have the ability to operate due to lack of labor. Particularly in specialty crops, in recent years, it has not been uncommon to hear of growers who were forced to leave their crop in the field because they could not find enough harvest workers.

Further, the industry faces a few unique challenges that likely make low unemployment more structural than in other industries:

- The ag labor force is aging.

- Declining immigration flows have reduced the overall number of ag workers.

- New minimum wage and overtime rules have significantly increased labor costs in a few key states.

- Demand for ag products is resilient meaning an economic downturn is unlikely to take pressure off labor needs.

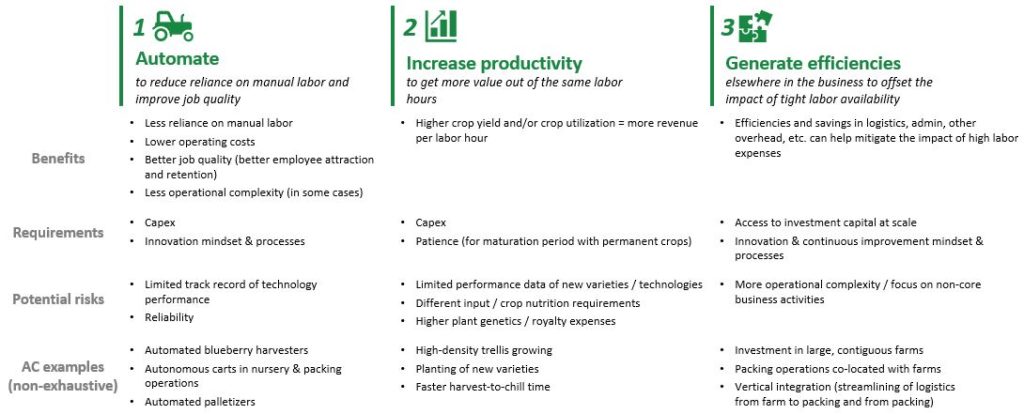

To face the challenge of tighter labor availability and higher labor costs, ag businesses, including AC, have focused on three key strategies:

- Automate to reduce reliance on manual labor and improve job quality.

- Increase productivity (e.g., crop yield and crop utilization) to get more value out of the same labor hours.

- Generate efficiencies elsewhere in the business to offset the impact of tight labor availability.

Agriculture Capital’s investment in mechanized blueberry harvesting technology provides a useful case study in strategy #1, automation. Harvesting blueberries in California and Oregon with machines (pictured below) instead of by hand reduces overall harvest cost per pound of fruit by roughly 2/3. The exact savings depends on several factors including variety, yield, labor costs, etc., but a ~66% reduction is a good rule of thumb. Fewer harvest workers are required, and each hour of labor is far more productive. However, there are drawbacks to machine harvesting. Machines are not as discerning as people; a higher share of harvested fruit may not be suitable for fresh consumption and must be diverted during the packing process. The mechanized harvest process may also bruise berries more frequently, further contributing to a lower fresh utilization rate and lower overall received price per pound. Finally, machine harvesters are expensive; implementation of this labor-saving strategy requires capital and sharp pencils for calculating financial returns. After evaluating all of these factors, AC has invested heavily behind machine harvesting technology primarily because of the risk posed by scarcity of labor and rising labor costs. Over time, as we have gained experience as perhaps the largest operator of blueberry harvesting machines in North America, we have improved our capabilities and mitigated the impact that machine harvesting can have on berry quality and fresh channel utilization.

With the rise of the agtech industry, automation solutions such as mechanized harvesting have garnered spotlight in recent years, but productivity and enterprise efficiencies are also essential. Depending on the circumstances of any given grower, adopting a higher-yielding variety or expanding operational scope may be a more beneficial use of time and capital than investing in robots. As growers consider all options for mitigating the impact of rising labor costs, methodical prioritization across all three labor strategies is key.

Enormous runway remains to implement these strategies and generate value. Ultimately, the results matter not only for those involved in the ag industry but for all of us as the world grapples with nutrition and food security risks amid a growing population and more volatile weather patterns.