In a world increasingly defined by inflation, geopolitical instability, and market volatility, investors are searching for assets that offer resilience, diversification, and consistent income. Layering stable lease income and regenerative management on top of historically strong land appreciation creates a strong case for farmland as a core portfolio holding.

Farmland’s investment fundamentals

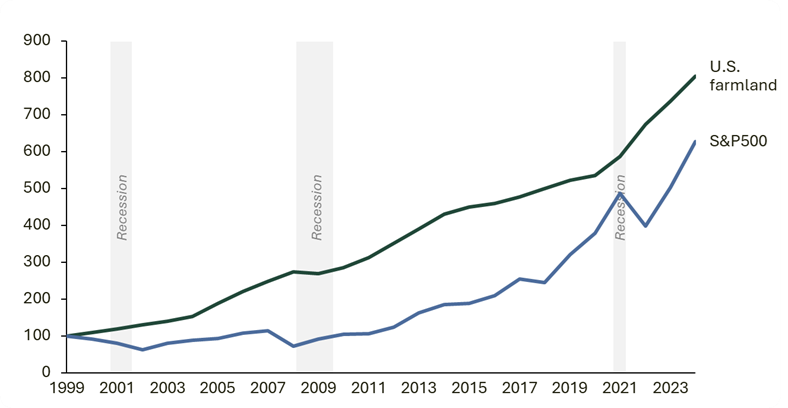

Farmland has quietly outperformed many traditional asset classes over the past two decades. From 2000 to 2024, US farmland delivered a compound annual growth rate (CAGR) of 8.95%, outpacing the S&P 500’s 7.91%. But performance is only part of the story.

US farmland performance compared to the S&P500, 1999-2023

Sources: USDA; NYU Stern

Farmland offers:

- Potential for current income. Nearly 40% of US farmland is leased, and buy-and-lease strategies allow investors to generate cash yield while maintaining long-term exposure to land appreciation. In today’s illiquid market, income-producing assets are increasingly attractive, especially when they don’t rely on short-term market cycles.

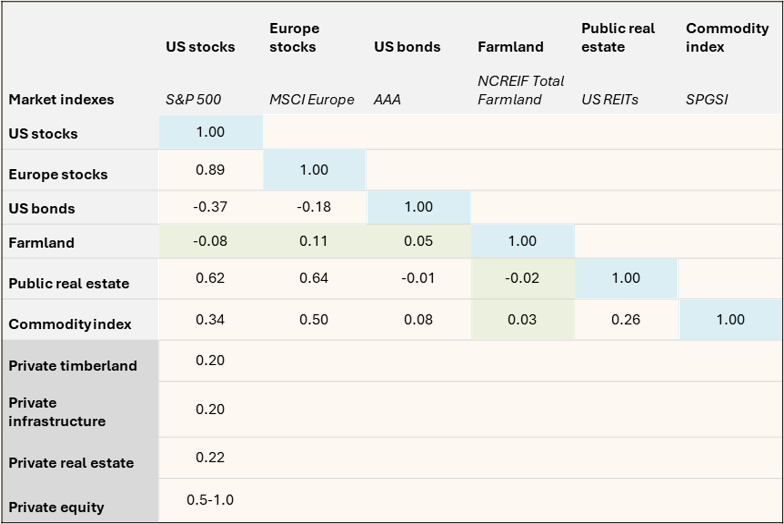

- Ability to mitigate risk. Farmland has demonstrated superior risk-adjusted returns compared to other asset classes. Its value tends to be less volatile, and it has historically held up well during economic downturns. This is partly because farmland is uncorrelated with equities, bonds, and other traditional investments. It behaves differently, which makes it a powerful tool for portfolio diversification.

Farmland is a strong portfolio diversifier, exhibiting a high Sharpe Ratio and low correlation to other asset classes

Sources: NCREIF Farmland Index, NEREIF Timberland Index, NCREIF Property Index, S&P500 Index, Internal Analysis; Note: Time period for correlation table ranges from 1999/2000-2021/2024

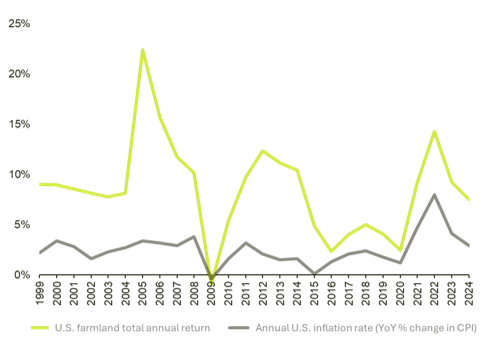

- A natural inflation hedge. Since 1970, farmland has delivered returns averaging about 6.5 percentage points above the Consumer Price Index (CPI), driven by rising land values from strong demand for limited agricultural supply and by rental incomes that tend to increase with overall price levels. These factors help preserve purchasing power, making farmland a strategic asset during inflationary or uncertain economic periods.

US farmland returns vs. inflation (1999-2024)

Annual percentage return (income and appreciation) / year-over-year % change in CPI

Sources: USDA; FRED

Why now?

Beyond the structural benefits of investing in farmland, we believe that now is a compelling time to invest for the following reasons:

- Supply & demand. Global food demand is rising, driven by population growth. By 2050, the world’s population is expected to increase by 20%, placing greater pressure on agricultural systems. At the same time, the supply of farmland is shrinking by the size of 165 football fields every hour. In the US, development continues to convert farmland into housing and infrastructure, reducing the acreage available for food production.

- Generational land transfer. Over the next 20 years, an estimated 300 million acres of US cropland — about one-third of total acres — are expected to change hands. This transition presents a rare opportunity for institutional investors to enter a market that has historically been fragmented and privately held.

- Nascent institutional asset class. Despite its potential, farmland remains a. Today, only 2% of US farmland is institutionally owned. That means the market is still early, and there is ample opportunity to shape its future.

Unlocking additional value through regenerative farming

Beyond traditional returns, farmland offers a unique pathway to impact-driven value creation through regenerative agriculture.

Regenerative farming practices, such as cover cropping, reducing tillage, and applying compost, can significantly reduce input costs and add additional revenue streams. According to Boston Consulting Group, farms adopting these practices can see profitability increase by up to 120%.

Beyond reducing input costs, regenerative practices nurture healthier soils that in turn produce more resilient yields. These farms are better equipped to withstand extreme weather events, thanks to improved water retention and reduced runoff. Research from the US Geological Survey suggests that regenerative practices can increase soil water-holding capacity by 20-25%, reducing irrigation needs during droughts and minimizing crop damage during heavy rains.

Regenerative farms can also monetize their natural capital through carbon, biodiversity, and water credits. The voluntary carbon market alone has grown from $400-500 million to $1.7 billion in 2024 and is projected to reach $15.7 billion by 2034.

How to invest

For investors seeking exposure to farmland, working with an experienced investment manager is key. AC’s approach is grounded in a decade of operational experience, a commitment to regenerative agriculture, and a track record of delivering both financial and environmental outcomes. Reach out to ir@agriculturecapital.com with any questions or to learn more about regenerative farmland as an investable asset class.

References

- Boston Consulting Group. (2023). “Cultivating Farmer Prosperity: Investing in Regenerative Agriculture.” Boston Consulting Group.

- Connery, H. (2025). “Deep Dive: The Performance Metric That Has Become Top of Mind.” PERE News.

- Farmland Information Center. “TFR: Tracking Farmland Retention.” American Farmland Trust.

- Global Market Insights. (2025). “Voluntary Carbon Credit Market Analysis.” GMI Insights.

- Lacy, K. (2025). “The Number of U.S. Farms Continues Slow Decline.” U.S. Department of Agriculture.

- Regional Hydrology Projects. “Increasing Soil Organic Carbon to Mitigate Greenhouse Gases and Increase Climate Resiliency for California.” United States Geological Survey.

- Sherrick, B., & Tsay, J.J. (2025). “The Relationship Between Inflation and Farmland Returns.” TIAA Center for Farmland Research.

- Smoley, R., (2023). “Farmland and the Institutional Investor.” Blue Book Services.

- United Nations. “Our Growing Population”. United Nations.

- Winters-Michaud, C. (2024). “Chart of Note: 2022 Censure of Agriculture: Share of Farmland Rented Holds Steady at 39 Percent.” U.S. Department of Agriculture.

- Zhang, W. “Farmland’s Inflation-Hedging Characteristics: A Comprehensive Analysis of Different Crop Types’ Responses to an Inflationary Environment.” Global Ag Investing.